Currency wallets

Wallets on the homepage

The wallets are displayed as cards showing the actual and available balance in the given currency.

Navigation and basics

Common page elements

Some page elements are available in most of the application pages

1 – Application switcher

2 – Navigation menu

3 – Main application area

4 – User options

5 – Company context switcher

Homepage

Your homepage gives you a quick overview of your FX account, balances in your currency wallets, and your recent transactions and provides you with quick links to the main functions.

1 – Main actions

2 – Currency wallets

3 – Recent transactions

Navigation

Navigation menu

Access functions in the current app via the app’s navigation menu

The page layout is automatically adjusted when the window size is changed. In such case the navigation bar will become smaller and eventually hidden.

Switch between applications

Use the app drawer icon in the top bar to switch between product and servicing applications available for you in the online portal.

Switch company context

Your user account can be linked to several company client accounts.

- Click on the company switcher in the top-right corner to switch between your companies

- When you log in to the application, the last used company context is normally shown.

When you log in to the application, the last used company context is normally shown.

Manage user preferences

- Click on the user icon in the top right corner to access user options

- Select My account to maintain your user profile and preferences

Set user language

In the My Account section:

- Select from the list of available languages and click on the Save button.

- Return to the main application via the application switcher in the top bar.

Log out

- Click on the user icon in the top right corner to access user options. Select Log out to exit the application.

- Select Log out to exit the application.

For security reasons, you will be automatically logged out by the system after 5 minutes of inactivity.

Frequently asked questions

See your current company context in the company switcher in the top right corner of the page.

Return to the main FX application via the application switcher in the top bar.

Access and login

Get access to the online portal

- Locate the invitation e-mail in your inbox, with the subject “Activate your account for FX and International payments”

- Open the activation link in the e-mail in your browser

- Follow the on-screen instructions to verify your identity by entering an SMS code sent to the phone registered with your invitation

- Set your password according to the on-screen instructions

Never share your login credentials for the application with anyone else.

Log in to the web application

- Open the online platform application app.fidoo.com/fox in your browser.

- Verify your identity with an SMS code sent to your phone

First steps in the application

After signup or login, you should see the homepage of your company’s FX account.

If your user account is activated for multiple companies, you should see the context of the last company which you have previously used in the application.

Setup new password

- Click the Forgot Password? link on the Login page and follow the on-screen instructions

- Verify your e-mail by entering a code sent to your mailbox.

- Verify your phone number via a code from SMS

- Set a new password

Frequently asked questions

- Check your SPAM or Junk folder

- Check if you have provided the correct e-mail

- Contact customer support

The validity of the invitation is seven days. If the invitation has expired before you managed to activate your account, please contact our customer support to request a new invitation.

Refresh the browser page, or log in again. If the problem persists, contact our customer support.

Please get in touch with our customer support

The verification codes are valid for 5 minutes. Please check the time of receipt of the e-mail or SMS and try again.

Use the Forgot password? link on the login screen and follow the on-screen instructions.

Add a card to your Apple Wallet

- Launch the Apple Wallet app on your device (Apple Wallet)

.

- In the Wallet app, click

. - Tap Debit or credit card to add a Fidoo card.

- Click Continue.

- Follow the on-screen procedure to add a new card.

- If you have an Apple Watch paired, you’ll get the option to add the card to your watch at the same time.

For more detailed information on setting up Apple Pay, follow this link.

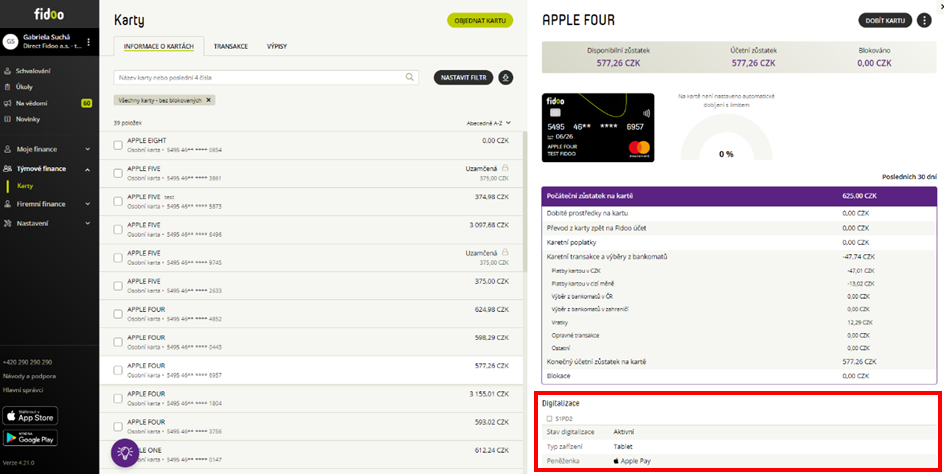

Displaying data about the digitisation of the Fidoo card

In the Fidoo web application, you can find information about the digitisation of the Fidoo card in the Cards section – Card Information tab in the details of the selected card:

Information about digitised cards is not available in the Fidoo mobile app. But you’ll find them in Apple Wallet on your device.

Conditions for digitising your Fidoo card

-

-

The physical Fidoo card must be:

-

personal (not team)

-

Active

-

-

The Fidoo card insertion device must:

-

support NFC

-

screen lock to be set on it – the phone unlocks after authentication (Face ID, Touch ID, PIN)

-

be iPhone with Face ID, iPhone models with Touch ID except iPhone 5S or iPad Pro, iPad Air, iPad and iPad mini with Touch ID or Face ID, or Apple Watch Series 1 and later

-

have iOS 14 and above to insert the card directly from the Fidoo mobile app

-

contain max. 10 digitised cards

-

-

Frequently asked questions

The Team Card cannot be used with Apple Pay. Only the personal Fidoo card can be digitised.

Yes, you can conveniently pay with your Fidoo card through this watch.

Yes, you can visit this website for verification: Apple Pay Compatible Devices – Apple Support (EN).

Add a personal card to Google Wallet

- Launch the Google Wallet app on your device (Google Wallet)

.

. - Click Add to Wallet at the bottom.

- Click on Payment Card (you will see all the cards stored under your Google account).

- Click on New credit or debit card (you can add a card using the camera or enter the card details manually).

- Confirm your choice by clicking Save at the bottom.

- After reading the publisher’s terms and conditions, select Accept.

- If you are asked to verify your payment method, select your preferred authentication option from the list.

- You will then receive a message and email notification that your card has been added and you can make contactless payments in stores, online and in apps where Google Pay is supported

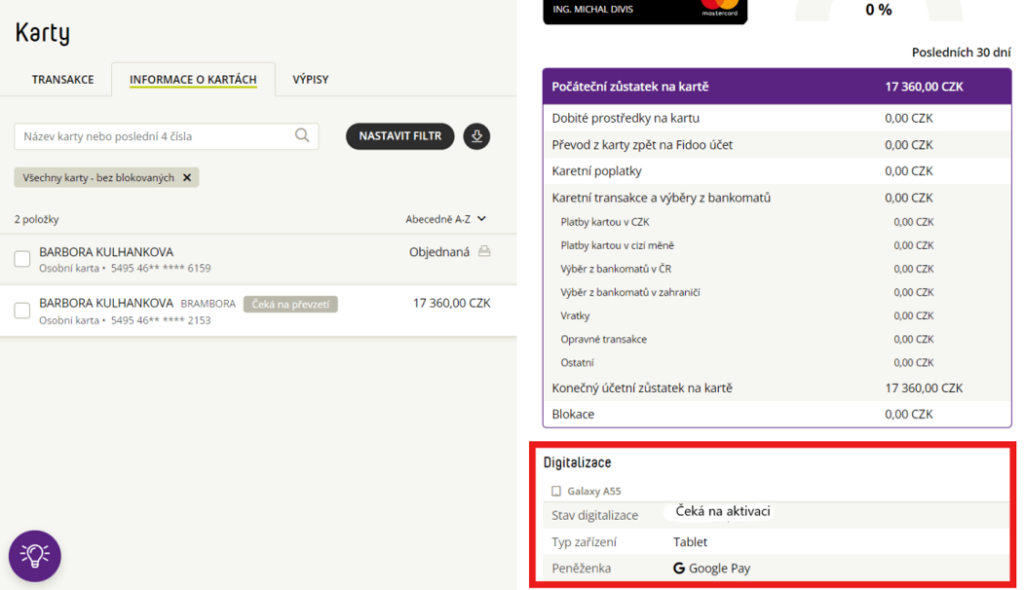

Displaying data about the digitisation of the Fidoo card

In the Fidoo web application, you can find information about the digitisation of the Fidoo card in the Cards section – Card Information tab in the details of the selected card:

Information about digitised cards is not available in the Fidoo mobile app. But you’ll find them in the Google Pay mobile wallet on your device.

Conditions for digitising your Fidoo card

The physical Fidoo card must be:

-

- personal (not team)

- Active

The Fidoo card insertion device must:

-

- support NFC

- have a screen lock set on it – the phone will unlock after authentication (fingerprint, gesture, PIN, etc.)

- Android 7 and above

- contain less than 20 digitised cards

Frequently asked questions

The Team Card cannot be inserted into Google Pay. Only the personal Fidoo card can be digitised.

Yes, Google Pay is also available for Fitbit wristbands. So you can conveniently pay with your Fidoo card via this bracelet.

Yes, you can visit this website for verification.

INSET s.r.o. reduced the volume of cash transactions by 70%

Cash minimisation

INSET s.r.o. reduced the volume of cash transactions by 70%

Check out this customer story from INSET, a company that has managed to significantly reduce cash transactions.

About the company

INSET s.r.o. has been a reliable company since 1991.

and operational partner of investors, project organisations

and building contractors.

Headquarters

Luxembourg 1170/7

130 00 Prague 3

Company size

174 employees

Industries

- Preparation, monitoring and diagnostics of buildings

- Geology, geophysics, geotechnics

The main difficulties

- Lengthy and complicated agenda around cash expenses

- Paperwork

Solution

- Prepaid cards for employees

- Electronic transmission of billing documents

- Digital archiving of receipts

Main benefits

- Digitisation and process automation

- Elimination of paperwork

- Simplify the distribution of documents from employees

- Interfacing with payroll and accounting system

Employees work on orders all over the Czech Republic

Since INSET Ltd. employees work on jobs all over the country, they often need to purchase materials exactly where the job is taking place. Therefore, the company was looking for the best way to handle the transfer of funds so that employees would not have to take long-term advances or prepayments before each trip.

In addition, employees had to make sure they had the cash they needed, the biggest burden was keeping receipts, getting the directors to sign receipts and then getting the paperwork to the accounts department.

INSET s.r.o. learned about Fidoo from a banker from Komerční banka, who knew that we were trying to automate the processes so that they would not take so much work.

"We dealt with the signing of receipts and with the whole agenda around there is quite a lot of running around and a lot of activities that are actually being dealt with in duplicate."

Jana Baxantová, Head of Finance, INSET s.r.o.

Fidoo cards for employees

Overall, INSET s.r.o. managed to reduce the volume of cash transactions by 70% with Fidoo cards. In one of the production divisions, cash transactions were kept to a minimum. Fidoo cards have also proved useful forbusiness trips abroad.

It also saves a lot of work that they can set limits for card users and the cards are automatically recharged. This prevents the employee from being left out of pocket.

The company also sees the fact that they can now conveniently shop online and purchase pay directly by card. Previously, they had to order COD or pay by bank transfer.

Automation of processes in the company

Thanks to Fidoo cards, the whole process around the transfer of funds in the company has been greatly simplified. It saves time for both card users and the accounting department.

According to Jana Baxantová, CFO of INSET s.r.o., it is generally advisable to pause over certain processes, look at them with a certain perspective, to analyze what activities they entail and whether there are any duplications that could be handled differently.

Fidoo from a user's perspective

Dominika Zajíčková, an assistant in one of the divisions, sums up the use of Fidoo cards as a great streamlining of work around expenses.

"The process is very simplified, I have it in a few clicks and then basically the data entered goes straight to the accounting department. I can just throw the receipt in the trash and I don't have to worry about it anymore."

Dominika Zajíčková, asistentka divize, INSET s.r.o.

Fields of activity INSET s.r.o.

- Geotechnics and monitoring

- Geological and geophysical survey

- Hydrogeology

- Pyrotechnic survey

- Diagnostics and monitoring of building structures

- Environmental diagnostics and monitoring

- Geodetic work

- Blasting service

- Engineering activities

Get inspired by other customer stories

Wienerberger has reduced the workload of its accounting department

Complete replacement of paper processes

Wienerberger has reduced the workload of its accounting department

Take a look at a customer story from Wienerberger, which has made a significant difference to its accounts department.

About the company

The Wienerberger Group is part of the multinational Wienerberger Ziegelindustrie AG, which is the world’s largest brick manufacturer and the leader in the production of baked roofing in Europe. The Group operates in more than 26 countries worldwide, including. in the UK, Austria, Germany, Czech Republic, Slovakia, Hungary, Poland, Belgium, France, Slovenia, Croatia, the Netherlands and Italy. In 1999, the company entered the US market with its brick products.

Headquarters

Plachého 388/28

370 01 České Budějovice

Company size

1500+ employees

Industries

Construction

The main difficulties

- Processing and archiving of receipts and other papers

- Cash transactions

- Manual data transfer

Solution

- Using Approval in the Application

- Payment by Fidoo card

- Connection to SAP

Main benefits

- Cost savings

- Fast billing

- Automation as such

Many people, many papers

Wienerberger is one of the world’s largest manufacturers of masonry materials – mainly burnt bricks and tiles. As a large company, they have over 1500 employees and with that came a very demanding administration around processing employee expenses.

"I was bothered by the inflexibility, papers were constantly being sent somewhere, something was always being copied, something had to be stored somewhere. There are a lot of employees and therefore we have a lot of these materials and things. I think the whole paper agenda is ossified - and it doesn't belong in the 21st century. Centuries."

Jaroslav Hule, vedoucí účetního oddělení

Fidoo from cards to teller machines

“I joined the company at a time when we were already using the Fidoo system a bit, primarily to manage company expenses. Only managers had Fidoo cards as such,…” Mr. Hule confided. Over time, the company started to use all the features that Fidoo offers.

How does the company work today?

The vast majority of expenses and travel orders are now processed only electronically. Basically, no more paperwork needs to circulate through the company. As a result, expenditure has also fallen, e.g. to send the papers. Another advantage is the actual digitisation of the materials and the entire agenda.

"...if a colleague wants to have a home office, she doesn't need to have access to the papers she used to have to keep in her office. This way everything can be done comfortably from home."

Jaroslav Hule, vedoucí účetního oddělení

Accountants and trust to Fidoo

In the long term, Mr. Hule said, the feedback from staff and accounting colleagues has been overwhelmingly positive. Understandably, there were some “birth pangs” in implementing the overall system, as many people generally perceive change as something that is not quite ideal, but even this has been overcome fairly well.

"I certainly haven't encountered any negative reactions recently."

Jaroslav Hule, vedoucí účetního oddělení

What is the biggest benefit for Wienerberger?

“Primarily cost savings, I guess. Then, of course, the speed of processing and the overall automation as such is a big bonus,” says Mr Hule. Today, Wienerberger already has automatic data transfer between Fidoo and SAP, which allows, for example, a document that in some cases has several thousand lines to be conveniently transferred to the system in one operation and does not have to be entered manually as in the past.