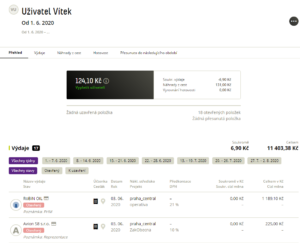

My billing

Clicking on one of the bills will bring up a detail of it in the right-hand section, showing:

- Quantification of expenditure for salaries

– A plus result means that the payment will be included in your salary

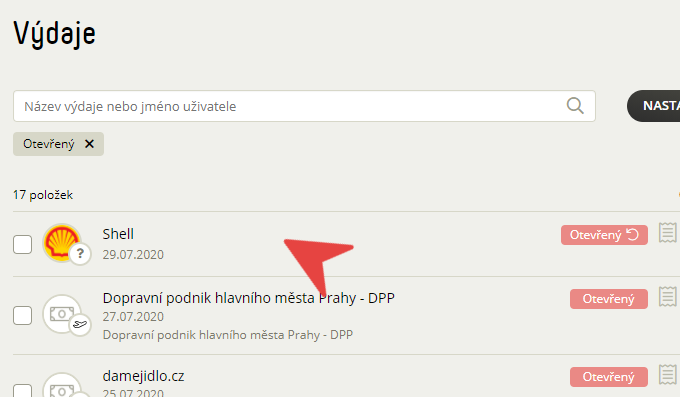

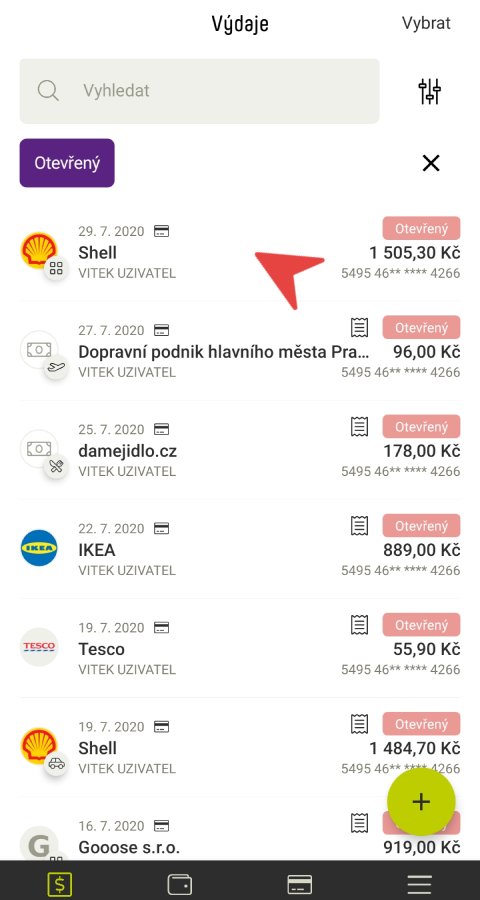

– A negative result means that the payment will be deducted from your wages. - A list of card expenses in a given period, ordered as incurred

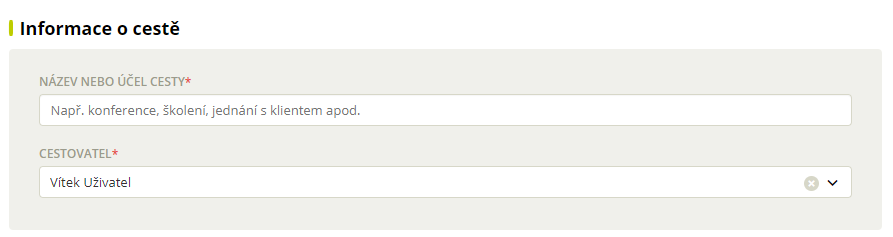

- Refunds from travel

- A list of cash expenditures during the period, ordered as incurred

- List of expenditure carried forward

Frequently asked questions about the web or mobile application

It runs on all mobile phones running iOS 13.4 or Android 6.0 or later.