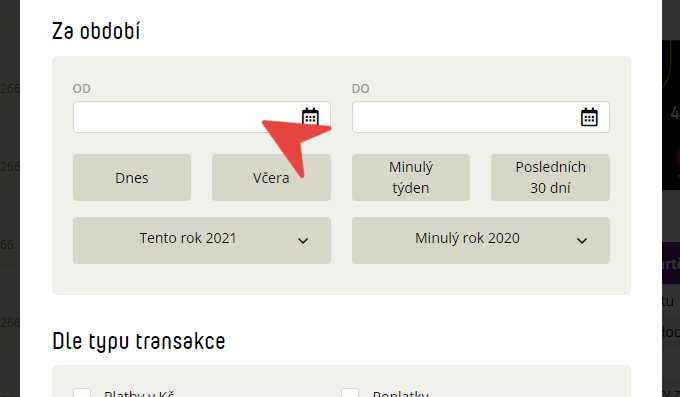

Filter and download card transactions

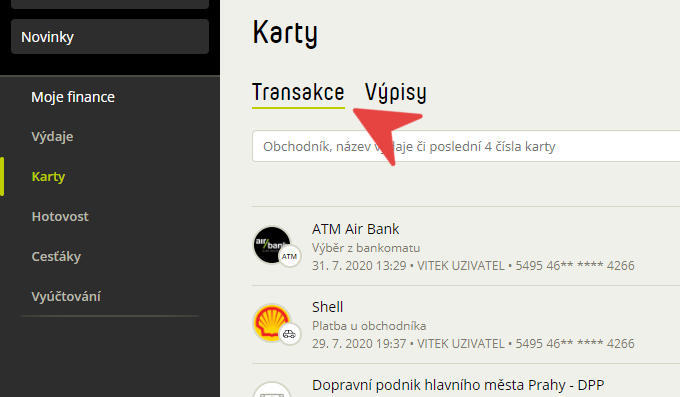

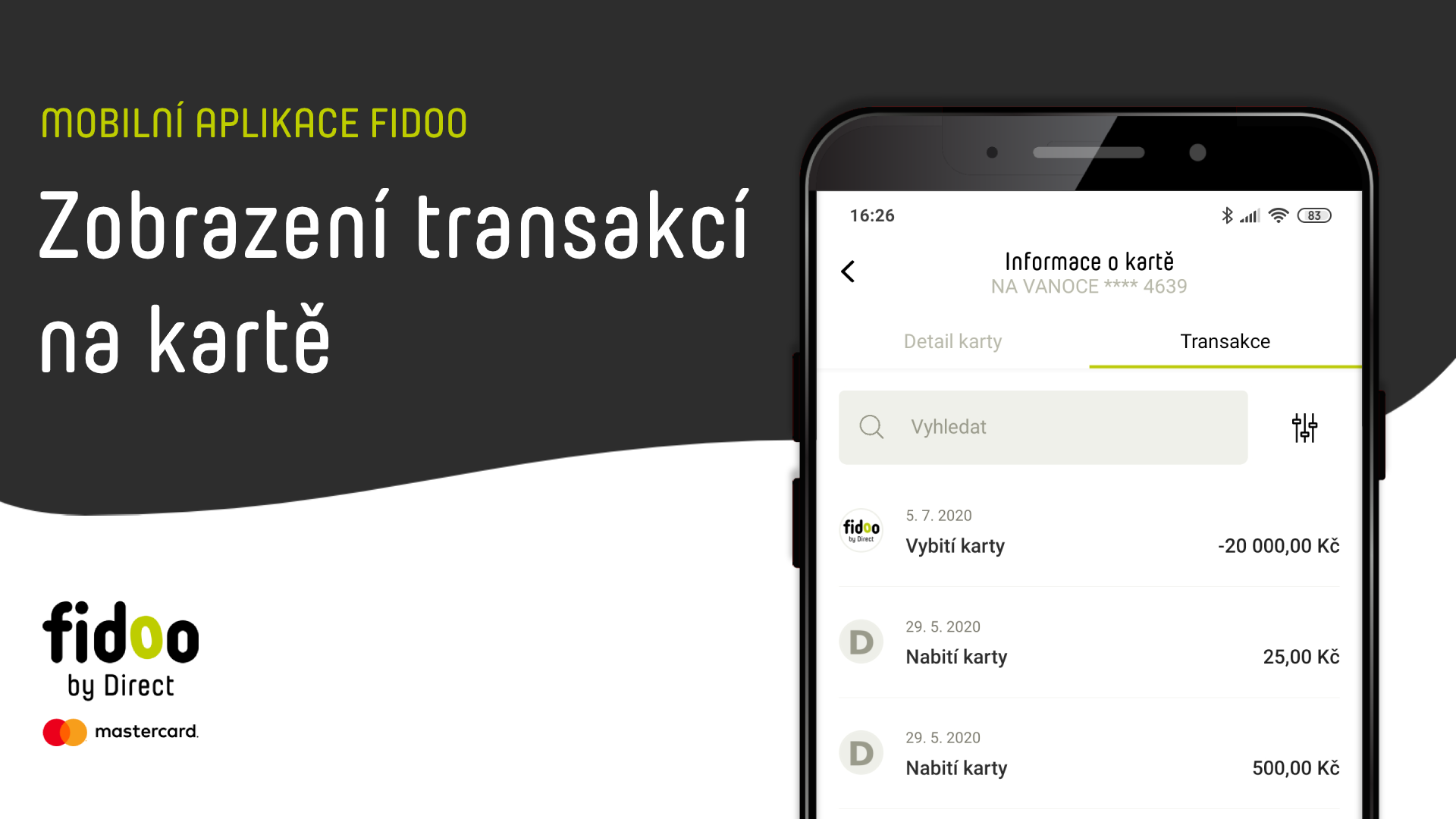

View transactions on the card

Play Video

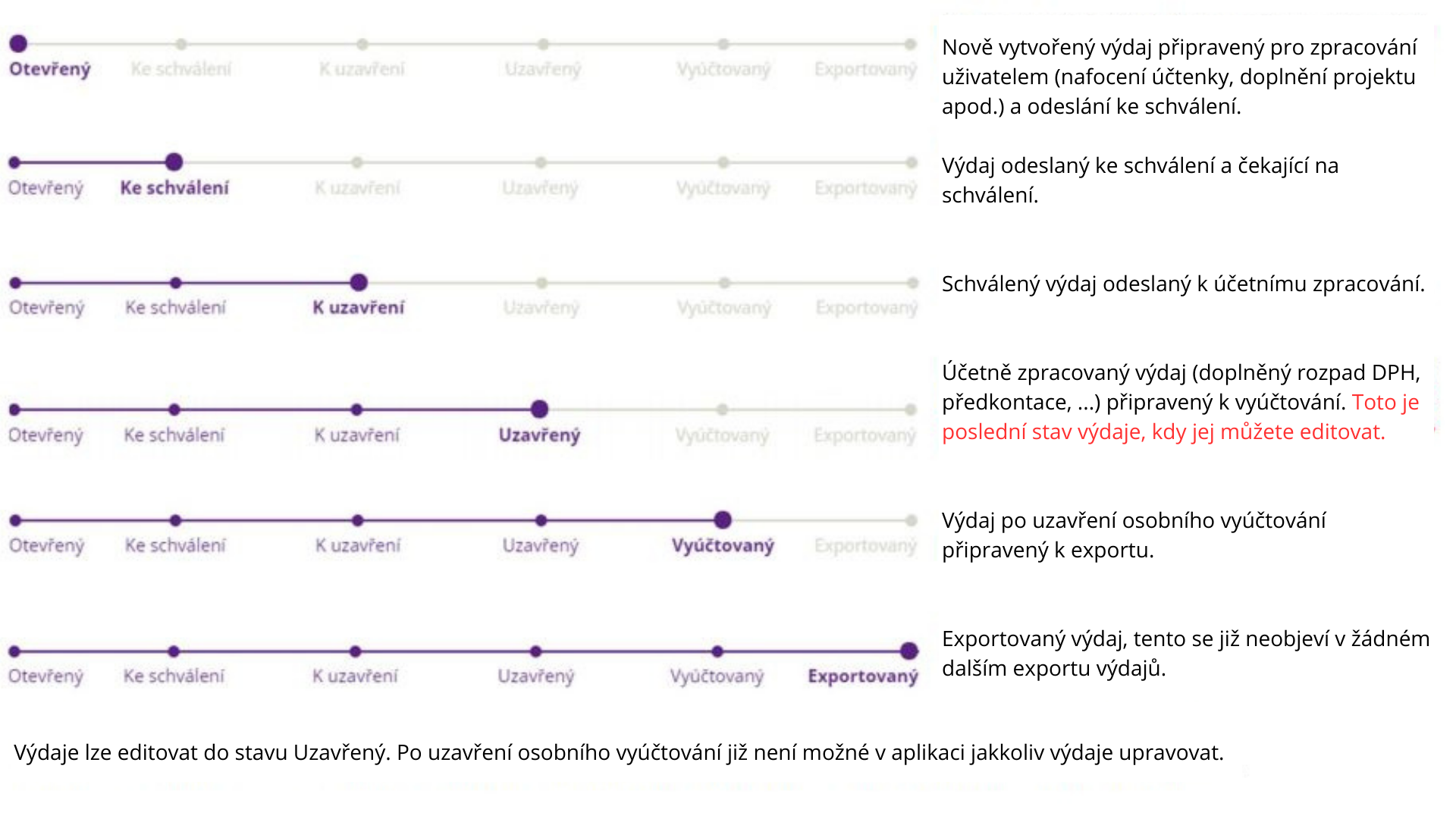

Transaction statuses

Blocked Transaction – the payment has been made but not yet accepted by the merchant, the blockage may last for several days.

Rejected transaction – the payment was not made for some reason (insufficient funds, wrong PIN, expired card, etc.)

This feature does not apply to external payment cards.

Transaction FAQs

- Check the validity of your card.

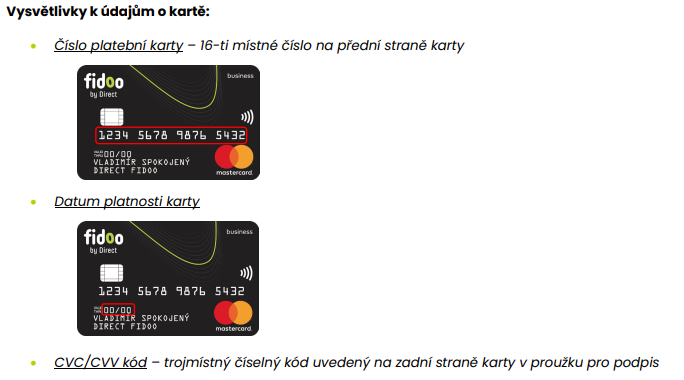

- Make sure you enter the correct details (PIN, card number, expiry date, CVC/CVV code).

- Make sure you have enough funds on your card.

- Check that you are allowed the payment method you are trying to pay with.

- If you have checked all of the above, please contact the customer service line.

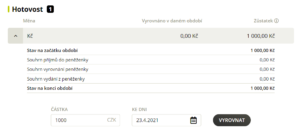

- My Finance – Cards – Statements – here you can find all monthly statements for your card.

- Click on the listing and the details will be displayed on the right side of the screen.

- You can download the extract using the Download to pdf button .

- In the case of external cards, you can find the statement directly on the bank’s website.