What is FATCA / CRS

FATCA, or the Foreign Account Tax Compliance Act, is a United States federal law that requires United States entities, including individuals, that are based outside the United States to report financial accounts that they have outside the United States. The law also requires foreign financial institutions to report the accounts of their U.S. clients to the Internal Revenue Service (IRS), the equivalent of the Internal Revenue Service in the Czech Republic.

The CommonReportingStandard (or “CRS” for short) is a uniform and global system for the automatic exchange of financial account information in the tax area. It was developed by the Organisation for Economic Co-operation and Development (OECD) and is designed to prevent cross-border tax evasion and tax fraud not only in the Czech Republic, but in all countries that have joined the CRS, respectively. he’ll come forward.

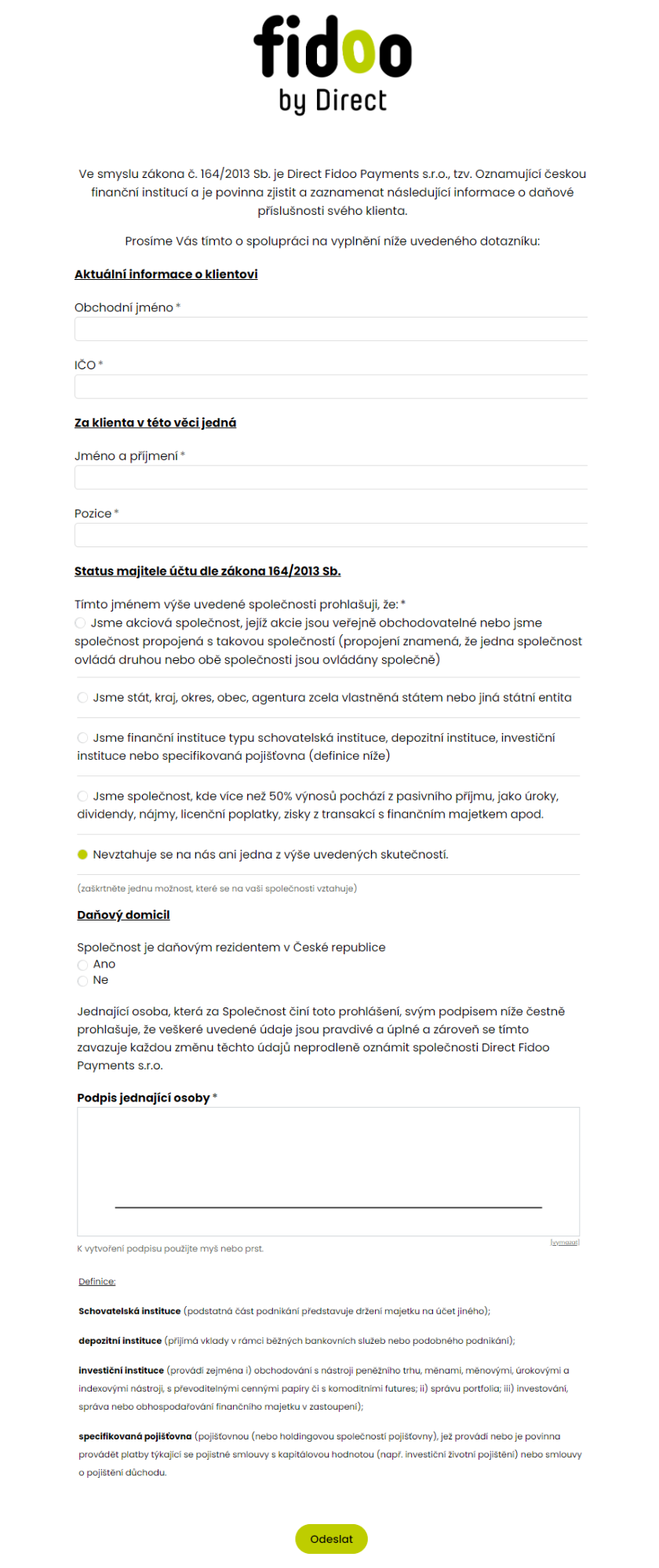

For the purposes of FATCA/CRS, Direct Fidoo Payments s.r.o., the so-called. The notifying Czech financial institution is obliged to find out and record information about the tax jurisdiction of its client.

Czech legislation

CRS and FATCA are regulated in Czech legislation by Act No. 164/2013 Coll., on International Cooperation in Tax Administration (the “Act”).

The Act regulates the procedural procedures for the automatic exchange of information obtained from financial institutions, including Direct Fidoo payments s.r.o., and at the same time unifies the procedures for the automatic exchange of information for tax purposes according to the global standard with the procedures required by the so-called “Fidoo Payments Act”. The FATCA Agreement concluded between the Czech Republic and the United States of America, which was published in the Collection of International Treaties under No. m. a.s.

What Fidoo Payments requires from clients

Fidoo Payments requires clients to fill in a simple online form in which the client confirms which type of company according to Law 164/2013 Coll. is and, if applicable, whether it is tax domiciled in the Czech Republic. If the client is not tax resident in the Czech Republic, then we need to know which country they are tax resident in, including your TIN (tax identification number).

Frequently Asked Questions

The Czech Republic has committed to the CRS and has implemented the CRS in Czech legislation. Czech financial institutions (i.e. banks, insurance companies, payment institutions, etc.) must check the tax status of their clients and report relevant clients to the tax authority.

- This is the definition of Czech tax residency under Czech law. If a natural person entrepreneur or legal entity does not have Czech tax residence, it determines its tax residence according to the relevant foreign legislation and related double taxation treaties.

- Legal entities / natural persons entrepreneurs – tax residents of the Czech Republic are usually those legal entities or units that have their registered office or place of management in the Czech Republic (i.e. the place from which they are managed). Legal entities that are not Czech tax residents determine their tax residence according to the relevant foreign legislation and related double taxation treaties.

The rules for determining tax residency may vary from country to country, if you are not sure where you are tax resident, we recommend you consult your tax authority or tax advisor.

This is a unique number assigned in a given country primarily for tax purposes. If you don’t know it, you need to find out the VAT number from the tax authorities in the country where you are tax resident

For example, in the Czech Republic, the tax administrator usually assigns a VAT number according to the following rules:

- Natural persons doing business usually have a VAT number based on the birth number without a slash (i.e. 9 or 10 digits), preceded by the prefix CZ.

- Legal entities usually have a VAT number based on the identification number (IČ) of the corporation or entity according to the Commercial Register, preceded by the prefix CZ.

This is a document issued by your local tax office (in the country where you are tax resident). The document is issued retrospectively upon request. This confirmation documents your tax residency in case we ask you to do so because we find a discrepancy in your data.

- An entity that is not an active non-financial entity, which has in particular the so-called. passive income:

- Basic definition of passive companies

- The company’s income from financing activities (within the income statement) accounted for more than 50% of the company’s total revenue.

- The company primarily owns real estate, which it leases more than 50%.

- The Company primarily owns interests in other companies and has more than 50% of its total gross revenues from dividends, licenses or patents granted, interest or bonds.

- The company’s activities are a combination of the above passive companies, i.e. it has more than 50% of its total gross income from leases of buildings, premises, apartments, warehouses, etc., dividends, bonds, interest, licenses or patents granted.

- Specific types of activities of a passive non-financial entity

- Activities of holding companies

- Activities of trusts, funds and similar financial entities

- Renting of own or rented real estate

- Activities of gambling halls, casinos and betting offices

- Basic definition of passive companies

So-called. dual residency for tax purposes is generally possible, but does not occur very often (in relation to the application of the rules of international double taxation treaties). However, due to different rules for determining tax residency in different countries, this situation may arise and you may have tax residency in more than one country at the same time – in this case, we need to know both of these tax residencies and the associated tax identification numbers. We will also require you to provide proof of these tax residencies by means of tax residence certificates from both countries.

Your data valid as of 31. 12., will be forwarded to the Czech tax administrator (tax office) no later than 30. 6. of the following year, who then forwards them to the tax authorities in the country where your entity is tax resident. The data is handled in accordance with applicable data protection legislation and is only disclosed to the tax administrator on the basis of legal requirements.

What will be reported to the tax authorities

- On the basis of the due diligence procedures carried out, Fidoo Payments is obliged to send data on an annual basis on the so-called. “notified accounts” to the Czech tax authorities.

Reportable account means: a financial account held by one or more Reportable Persons (or a passive non-financial entity with one or more beneficial owners who are Reportable Persons)

Reportable Person means: an individual or entity that is resident in the Reporting Jurisdiction under the tax laws of that jurisdiction, except:

- entities/legal persons regularly traded on securities markets and their related persons

- of a government entity

- international organisations

- central banks and financial institutions

Reported data:

Identification of the persons to be notified who are account holders or beneficial owners of entities/legal persons:

- Name

- address

- country of tax residence

- TIN/TIN

- date of birth

- place of birth

Identification of the entity/legal person to be notified:

- Title

- registered office address

- country of tax residence

- TIN/TIN

Account number of the (notified) account

Name and identification number of the financial institution

Account balance or value at year-end/account closure

Note: In the case of a zero or negative balance, zero is reported.

If the account was closed during the year, then the value at the time of closure.